If you ship your goods to a country outside the European Union, you must comply with customs rules and procedures. First of all, you have to make sure that the goods you are sending are authorized in the country of destination and prepare your customs documents in advance.

In this article, we will detail how to correctly complete an export/import commercial invoice to facilitate the customs clearance procedure.

How to fill out a commercial invoice and what is it?

The commercial invoice also called "customs invoice" is issued by the exporter, once the sale transaction has been confirmed.

For an international shipment, you must attach 3 copies of the commercial invoice. One copy for the country you are exporting from, one copy for the country you are sending to and another copy for the consignee.

Then you have to insert the 2 copies in an adhesive envelope that you will stick on the package and another copy inside the package for the recipient.

The difference between the commercial invoice and other customs documents

The Commercial Invoice is intended to facilitate the customs clearance process and avoid delays. It must contain important information of the exported goods, so that customs can calculate the value of the good as well as the duties and taxes. Consignee must pay once goods arrive at destination.

- The packing list

This is another document required by customs to verify compliance with what is on the invoice. On the packing list, the specific content of each package is detailed (dimensions, weight, shipping mark, packaging used, etc.).

Please note: Not to be confused with the proforma invoice which is a provisional invoice or price estimate that is sent before a sale is made.

- The proforma invoice

Proforma invoice is also used to declare customs value. With this type of invoice, you can send samples or spare parts. Once the sales proposal has been validated, you will then need to provide a commercial invoice with the goods.

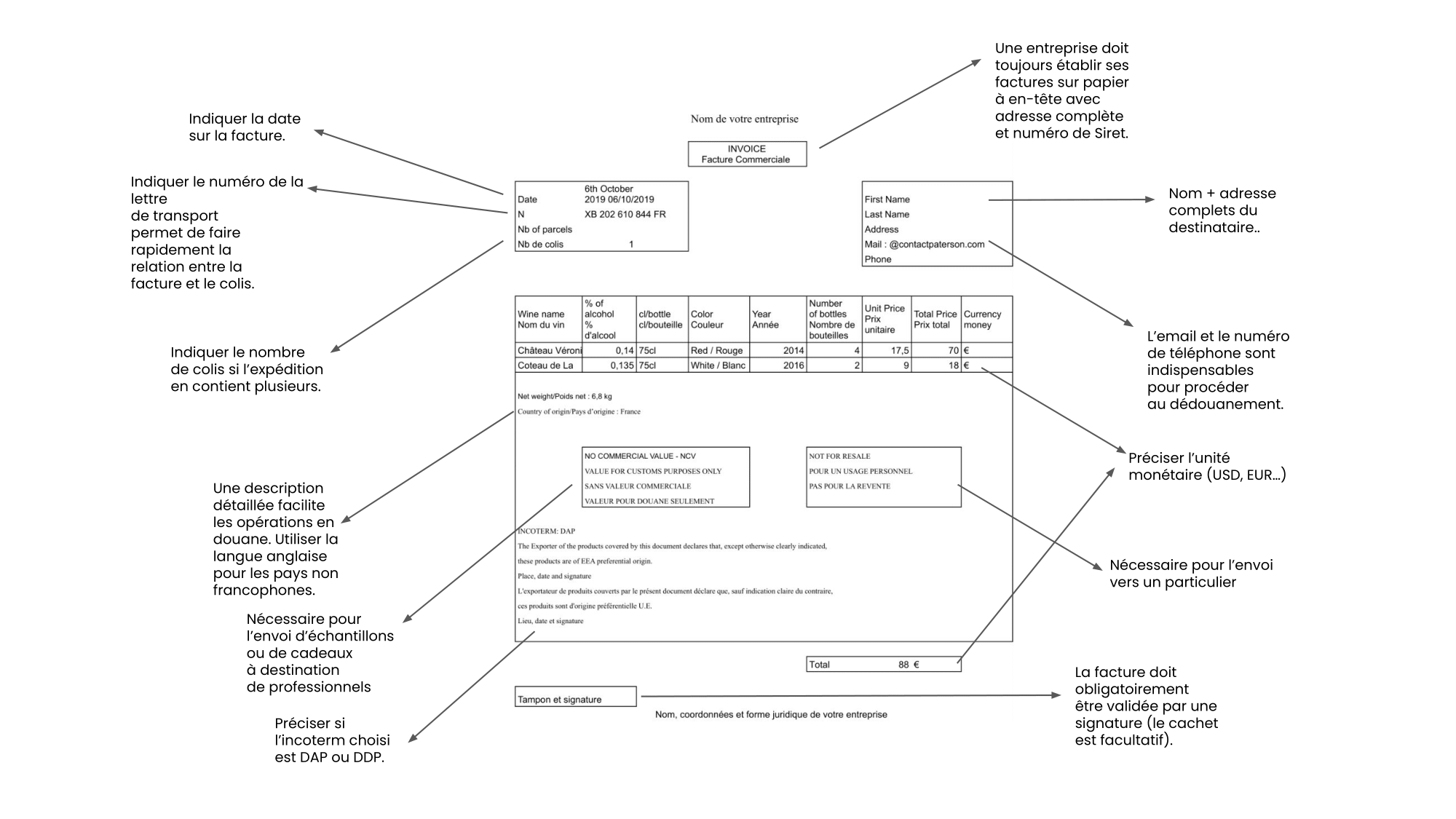

Commercial Invoice Example

Compulsory mentions of the commercial invoice

The mandatory information that must appear on the commercial invoice is as follows:

- Names and addresses of seller and buyer

- Issue date, invoice number

- EORI

- Description and quantity of goods

- The weight of the goods

- Currency and terms of payment

- Means of transport and terms of delivery

- HS Code

- Incoterm

The HS Code

The Harmonized System (HS code) is a 6-digit number allowing customs to classify products shipped by category. Thanks to this code, customs calculate the duties and taxes and apply the restrictions in force.

If you do not include the HS code on the commercial invoice or other shipping documents, your recipient may incur additional charges and shipment may be delayed. This is why it is important to fill in the correct code on the commercial invoice.

Example:

Category: Clothing and clothing accessories (62)

Subcategory: T-shirts, jerseys and other undershirts (11)

Material: Cotton (42)

Code SH : 621142

Incoterm

Incoterms are the reciprocal obligations of the seller and the buyer under an international purchase/sale contract.

For example, the Incoterm DAP (Delivered At Place) is the incoterm for online sales. As a seller, you bear the costs and risks until the products arrive at their destination. On the contrary, all import and customs fees will be the responsibility of your customer.

The EORI number

If you are exporting or importing outside of the EU, you will also need to indicate the EORI number on your commercial invoice. It is used to identify who is importing or exporting goods. It is necessary for customs formalities and used in tele-procedures related to customs clearance. This way, you will avoid delays or fines at customs. Since January 1, 2017, it is mandatory to mention the EORI on invoices in the EU.

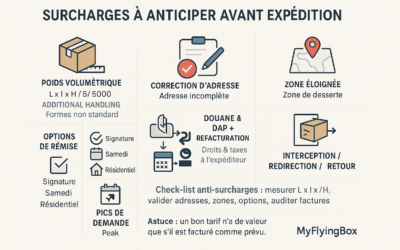

It is important to complete these documents very carefully. If the documents contain errors, you may be faced with paying additional customs fees. Moreover, it would be wise for you to keep a copy of the commercial invoice and possibly of the CN22 or CN23 document.

Regarding the requirements that invoices must contain within the European Union, please consult Regulation (EEC) no 2454/93.

What to do if there is a mistake on the invoice?

If the commercial invoice contains an error in entering the name or address of the recipient or an error in the description of the contents of the package, this may cause problems at customs or delays in delivery.

However, it is possible to correct these errors in the event that your customer has not yet paid for the goods. For example, you can always notify him to explain the situation and then send him the correct invoice. If your customer has already paid, you can issue another invoice.

Dematerialize and facilitate your sending of documents via DHL or UPS

If you ship with DHL or UPS outside the European Union, you can use the service "Paperless Trade » available online at the website of DHL or the website of UPS .

You simply need to enter the information regarding the contents of your shipment. The information will thus be available in electronic format and automatically sent electronically to the carrier.

You can also use the feature "Download my forms » on the UPS site if you wish to send additional documents.

What are the advantages?

You will save time and money and the customs clearance process will be much easier. In addition, you also reduce the risk of losing documents.

My Flying Box, your shipping partner

Thanks to our platform, you have the choice of several carriers and flexibility on delivery methods. Registration is free, immediate and without obligation. We support our customers for a quick start of our tool and our features.

If you need more specific advice, we are experts in packaging, customs, insurance, export, e-commerce modules/API, VAT etc…

We organize workshop online to answer all your questions. Book a time slot now and take part in our onboarding workshops! So you will benefit from:

- Setting up your personalized account

- Test expeditions

- Overview of related services: open an incident, insurance file, packaging best practice…

0 commentaires